A credit score is a three-digit number used by lenders to assess your creditworthiness, that is, how likely you are to repay borrowed money on time.

Lenders use your credit score to decide whether to approve you for new loans or credit cards, and determine your credit limit and interest rate. Landlords, employers and insurers might also use credit scores during their evaluation process.

Read on for a breakdown on how credit scores work and the most common factors that impact them.

How Do Credit Scores Work?

Credit scoring models analyze your credit reports from the three major credit monitoring agencies and assign a three-digit number between 300 and 850.

Each individual’s score is calculated based on several factors, such as payment history and credit utilization. The higher your score, the less risky lenders consider you, so you’ll have more credit options and better terms.

There are different credit scoring systems available, the most popular being FICO and VantageScore. Each model has several versions and some are even tailored to specific lending industries, like mortgage and auto loans. However, most creditors use FICO score models.

How are credit scores calculated?

Credit scores are calculated using financial information that’s gathered by the major credit bureaus: Experian, Equifax and TransUnion.

These credit reporting agencies collect data from lenders to create a credit report for every consumer. This file will outline your credit history, including your payments and account balances.With this information, credit scoring models evaluate five main factors: payment history, credit utilization, credit mix, credit inquiries and credit age.

How influential a factor is depends on the model used by a lender. As a result, different scoring models can produce different credit scores, even if they reference the same credit report. However, note that most models usually place more importance on your payment history and overall credit utilization.

Difference between credit scores and credit reports

Your credit score is not the same as your credit report. Credit scoring companies use the information on your credit report to determine your credit score. A credit report documents your credit history, and credit scoring models use it to determine your creditworthiness and, consequently, your score.

Factors that make up your credit score

Both the FICO and VantageScore models use similar factors to calculate scores. However, each system weighs financial data a bit differently. Here is what you need to know:

| FICO | VantageScore 4.0 |

| Payment history (35%) | Payment history (41%) |

| Amounts owed (30%) | Age/mix of credit (20%) |

| Length of credit history (15%) | Utilization (20%) |

| New credit (10%) | New Credit (11%) |

| Mix of credit accounts (10%) | Balance (6%) |

| Available credit (2%) |

Payment history

Your payment history is the single most important factor in both scoring models. Paying your bills on time will increase your credit score over time, while late payments of 30 days or more can knock off 100 points or more from your score and will be reflected on your report for up to seven years.

Amount owed or utilization

Scoring models consider your credit utilization ratio, that is, how much credit you use compared to your available total. To have a good credit score, experts recommend keeping your utilization at or below 30% — however, the lower the better.

For example, if you have a card with a $10,000 credit limit, you should aim to use $3,000 or less each month. However, keep in mind that this factor also takes into account the debt you’re carrying across multiple accounts. So if you have three cards with a combined credit limit of $40,000, your outstanding balances should not exceed $12,000.

Age or length of credit history

One of the most common credit score myths is that no credit is better than bad credit. The truth is, however, that the older your accounts, the better for your credit score.

Creditors prefer borrowers with extensive credit histories because it lets them better assess their creditworthiness. While there are no tips to lengthen the average age of your credit faster, you can avoid shortening it by keeping your oldest accounts open if possible.

New credit

Be mindful of how often you apply for new loans or credit cards. If you have too many new accounts, lenders may consider you a risky borrower. This may also negatively impact your score as credit applications generate a hard credit inquiry that can lower your score by a few points.

Credit mix

Having different types of accounts, such as a credit card and a car loan, can help boost your score. Lenders like to see a variety of credit since it shows that you are able to pay back different types of debt reliably.

How to obtain a free credit score

You can use credit monitoring services, such as Credit Karma, to check your credit scores for free. However, these services often provide your VantageScore, and lenders use the FICO system much more often. While both scoring models use similar factors and scales, they still weigh your financial information a bit differently.

You can get your FICO score by purchasing it directly from the FICO website. But some credit card companies, like American Express, include it free of charge as a perk for consumers.

What constitutes a good credit score?

The FICO scores range from from 300 to 850 points, where scores between 670 and 739 are considered good. Scores above that range are considered very good or exceptional.

The VantageScore model has a similar range and scores between 661 and 780 are good, while anything above that threshold is excellent.

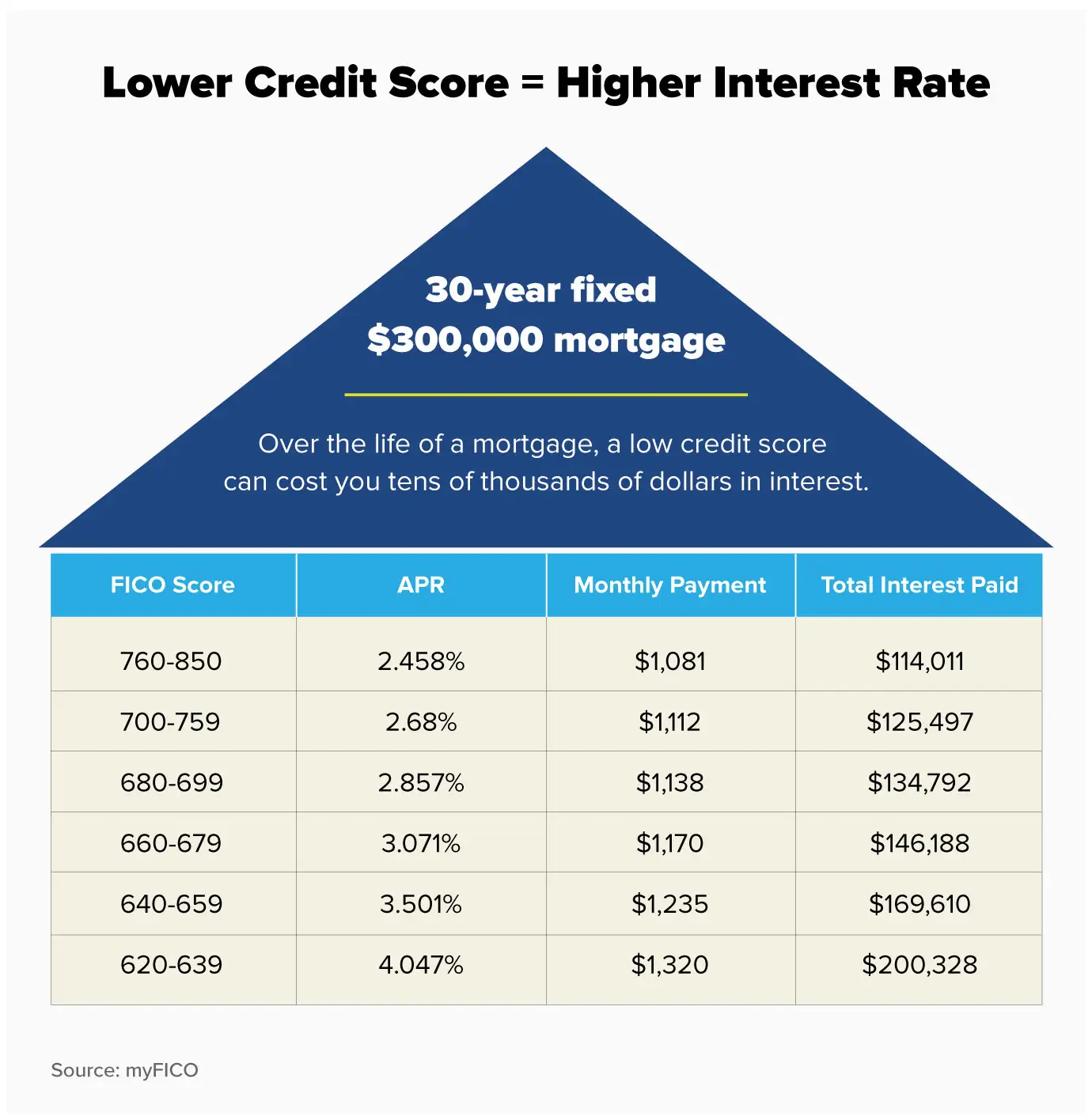

Good credit scores can increase your chances of approval when you apply for loans and credit cards. It will also increase how much you can borrow when applying for a mortgage and other types of financing, like car loans, personal loans. Additionally, creditors will offer you higher credit limits on your cards and better interest rates.

A good score can also be beneficial while finding a house or apartment to rent. Many landlords and property managers use scores to evaluate your application since a good credit score can indicate you are a responsible tenant that’s likely to pay rent on time.

Types of credit accounts

Having different types of credit accounts on your report can improve your score as it demonstrates that you can manage different kinds of debt. These are the two main types:

Installment loans

Installment loans refers to loans for a specific amount of money and with a fixed repayment schedule, for example, student loans and mortgages. Installment loans require set monthly payments and missing them can lead to late fees and your credit score dropping.

Revolving credit

This type of account allows you to borrow as often as you’d like up to a predetermined limit as long as you pay back at least some of the borrowed amount. As you pay down your balance, credit is once again available. An example of revolving credit would be a credit card or a home equity line.

Revolving credit accounts let you carry a balance over to the next month. However, this means that interest accrues on the outstanding balance, making it grow month to month. To avoid these additional charges, you should try to pay the balance off in full every month.

What Can Lower Your Credit Score?

Your credit score can drop if you miss payments or max out your cards frequently.

These are some of the most common factors that can lower your credit score:

Bankruptcy

Filing for bankruptcy can make your credit score drop by 200 points or more, and the filing will be reported in your report for up to 10 years.

Foreclosure

If you are delinquent on your mortgage payments, the lender can foreclose the property, that is, take ownership of it. Foreclosures can have a significantly negative impact and stay on the report for seven years.

High credit utilization ratio

Having one or more cards in good standing can help your score, but if you’re using more than 30% of your available credit, it can start impacting it negatively.

Late payments

Just one late payment can lower your score by 100 points or more, and remain on your credit report for up to seven years — and the longer the payment is overdue, the greater the impact on your credit score. For example, a payment that is 30 days late has a smaller impact than one that is 90 days late.

Credit inquiries

A credit inquiry (also known as a credit check or credit pull) happens when lenders look at your credit report.

There are two types:

A hard inquiry can lower your credit score, but it’s only briefly and by a few points. It’s more important to avoid having too many hard inquiries on your credit report within a short period of time since lenders may think you are taking on too much debt and consider it a sign of financial instability.

| Hard inquiry | Soft inquiry |

| Tied to a formal loan or credit application | No formal loan or credit application linked to the inquiry |

| Lenders use it to accept or reject your application | Lenders and credit card issuers employ it to pre-approve candidates |

| Must be authorized by you | Prospective employers and even phone companies do soft checks as part of your evaluation without your authorization |

| Remain on your report for up to two years | Is not reflected in your report |

| Too many can lower your overall score | Are only visible to you and don’t impact your score |

Common mistakes on your credit report

When you check your credit report, watch out for common mistakes such as:

- Incorrectly reported late payments

- Accounts that belong to another person

- Closed accounts reported as open

- Same account listed more than once

If you spot one of these mistakes, they could simply be due to a reporting error from your creditor or the reporting bureau. However, note that it may indicate that you’re a victim of identity theft and someone else is using your personal to apply for credit.

How to fix credit report errors

Start by reviewing a copy of your credit report. You can get weekly copies through AnnualCreditReport.com.

If you spot a mistake, such as an unauthorized hard inquiry, you should contact the credit bureau that generated the report to request it remove the incorrect item. Note that you can remove incorrect items from your credit report for free, but the process can be time consuming. If your file has several errors, you should consider hiring a credit repair company.

You should also look into credit counseling if you want more personalized advice to improve your financial situation. Nonprofit organizations such as the National Foundation for Credit Counseling (NFCC) can help you better understand your finances and improve your score over time.

Summary of Money’s Guide to What is a Credit Score?

A credit score measures your creditworthiness and guides the creditor’s lending decisions on loan rates, terms and loan amounts. Credit scoring companies use data from your credit report — a detailed record of your borrowing history and behaviors — to calculate your credit score.

You need a good credit score to qualify for better loan terms and interest rates. A poor credit score does not disqualify you from borrowing money, but it does make it harder. Poor credit limits your lender options, raises your interest rates, and can even disqualify your loan application.