*Rates and APRs are subject to change. All information provided here is accurate as of August 28, 2024.

Money’s Main Takeaways

- Home equity loans let you access the equity you’ve gained in your home over the years.

- These loans often have lower interest rates than personal loans and credit cards, making them a more economical way to get extra cash.

- Tapping into your home equity can be one way of restructuring your debt to improve your personal finances.

- Money’s editorial team researched and evaluated over 35 home equity providers, looking at interest rates, fees and qualification requirements, among other factors.

- After careful review, we chose Discover for its low fees, Figure for its fast approval time, and Flagstar for large HELOCs.

Why Trust Us?

Our editors and writers evaluate home equity loan and HELOC providers independently, ensuring our content is precise and guided by editorial integrity. Read the full methodology to learn more.

- Reviewed 38 providers

- 1,000+ hours of research

- Based on 14 data points, including APRs, loan limits and approval time

Best Home Equity Loans Reviews

The companies listed below are in alphabetical order.

Best Home Equity Loan Lenders Reviews

- No appraisal fees or closing costs

- 0.25% off with AutoPay if using a Citizens Checking account

- Choose full or interest-only payments during 10-year draw period

- Only for properties in certain states

- $50 annual fee after the first year on standard HELOCs

HIGHLIGHTS

- Annual Percentage Rate (APR)

- 8.50% to 21.00%

- Loan Amounts

- $5,000 – $25,000

- Terms

- 10 years

- Max. Loan-to-Value (LTV)

- Not disclosed

Why we chose this company: Citizens Bank (NMLS #433960) has consistently garnered good customer reviews and high marks in independent, third-party customer satisfaction surveys, making it our choice for providing the best customer experience.

Citizens Bank ranked among the top ten mortgage lenders in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Survey, which considers six factors when determining the customer’s overall experience score, including level of trust, client communication and problem-solving.

The bank has two home equity lines of credit (HELOC) products: the standard line of credit, which offers credit lines starting at a minimum of $17,500, and the Citizens GoalBuilder, which has a minimum of $5,000 and a maximum borrowing limit of $25,000.

With Citizens’ Fastline application, you can obtain a personalized rate and line amount in a few minutes without impacting your credit score. Once you review and accept the bank’s offer, you could close in as little as seven days and receive your credit line as soon as two weeks. Sign up for autopay from any Citizens Bank checking account and qualify for a 0.25% rate discount.

Eligibility requirements

- Property type – Owner-occupied 1- to 4-family properties or condominiums

- Credit score – Not disclosed

- Amount of equity available – Not disclosed

- Regional availability – Available in Alabama, Arkansas, Connecticut, Washington DC, Delaware, Florida, Georgia, Iowa, Illinois, Indiana, Kentucky, Massachusetts, Maryland, Maine, Michigan, Minnesota, North Carolina, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Virginia and Vermont.

See rates on Citizens Bank’s Secure Website >>

- Loan amounts from $5,000

- No annual fee

- 15-year draw period available

- A credit union membership is required

- Closing costs can range from $175 to $2,000

- Home equity loans not available in Maryland, Texas, Hawaii and Alaska

HIGHLIGHTS

- Annual Percentage Rate (APR)

- 7.14% – 9.41%

- Loan Amount

- From $5,000

- Terms

- 5 to 15 years

- Max. Loan-to-Value (LTV)

- 90%

Why we chose this company: Connexus Credit Union (NMLS #649316) offers home equity loans with flexible repayment terms ranging between five and 15 years in addition to its interest-only home equity line of credit.

Connexus’ interest-only HELOC allows you to pay the accrued interest during the loan’s draw period of the loan instead of principal and interest payments. Making interest-only payments on the amount withdrawn is a convenient option if you need to start out with lower payments and are sure you can afford the higher payments in the future.

The monthly payment on the credit union’s standard credit line of credit is 1.5% of the amount borrowed. Connexus is currently offering qualified borrowers a fixed introductory rate lock on both HELOC options until April 2025, after which the interest will become variable.

Eligibility requirements

- Property type – Primary home and second homes (single-family homes, 2-4-unit condominiums, owner-occupied duplexes, or townhouses)

- Credit score – Not disclosed

- Amount of equity available – Minimum 10%

- Regional availability – Home equity loans not available in Maryland, Texas, Hawaii or Alaska.

Read Connexus Credit Union Home Equity Loan Review

See rates on Connexus’s Secure Website >>

- No origination, appraisal or application fees or mortgage taxes due at closing

- No prepayment penalty

- Full online application process

- No information regarding discounts

HIGHLIGHTS

- Annual Percentage Rate (APR)

- Check Website for Details

- Loan amounts

- $35,000 – $300,000

- Terms

- 10 to 30 years

- Max. Loan-to-Value (LTV)

- 90%

Why we chose this company: If you want a lender that doesn’t charge a lot of fees, Discover (NMLS #684042) is a great option to consider.

When you apply for a Discover home equity loan, you don’t pay application, origination, or appraisal fees. You also won’t pay any upfront closing costs or loan processing fees. The online lender offers competitive, fixed interest rates and repayment terms between 10 and 30 years.

You can borrow up to 90% of your available home equity and the loan can be either a first or second lien. Loan amounts range from a minimum of $35,000 to a maximum of $300,000. The application process is completed fully online and eClosing allows you to sign and submit all closing documents digitally as well.

Eligibility requirements

- Property type – Primary residence (single-family residences, condos and townhomes)

- Credit score – Minimum of 680

- Amount of equity available – Usually between 10% to 20%

- Regional availability – Available nationwide.

Read Discover Home Equity Loans Review

See rates on Discover’s Secure Website >>

HIGHLIGHTS

- Annual Percentage Rate (APR) Range

- 7.50% – 17.20% (Conditions apply)

- Loan Amount

- $15,000 – $400,000

- Terms

- 5, 10, 15 and 30 years

- Max. Loan-to-Value (LTV)

- Not disclosed

Why we chose this company: Figure (NMLS #1717824) offers a completely online application process, quick approval times and funding in as little as five days.

The fintech company stands out for its streamlined application, which lets customers check their rate, apply and know if they’ve been approved within minutes. The process includes an eNotary who confirms customers’ identity and reviews mortgage applications and documents electronically. In addition, loans can be funded within five days after approval.

Figure’s loan amounts for HELOCs range from $15,000 to $400,000 with fixed interest rates and loan terms of five, 10, 15 and 30 years. Figure doesn’t charge maintenance fees, account opening fees or prepayment penalties. However, it charges a one-time origination fee of up to 4.99% of the initial draw.

Eligibility requirements

- Property type – Single-family residences, townhouses, urban developments and condos

- Credit score – Minimum 640 for primary residences and 680 for non-owner occupied or investment properties

- Amount of equity available – Not disclosed

- Regional availability – Not available in Delaware, Hawaii, Kentucky, New York, or West Virginia.

See rates on Figure’s Secure Website >>

- Line amounts of up to $1 million

- 0.25% rate discount with AutoPay

- 1 to 4-unit properties and modular homes are eligible

- $75 annual fee after first year

- Not available in Texas, Puerto Rico or the U.S. Virgin Islands

- HELOANs are only available in states with a branch office

HIGHLIGHTS

- Annual Percentage Rate (APR)

- 9.49% – 21.00%

- Loan Amount

- $10,000 – $1,000,000

- Terms

- 10-year draw period, 20-year repayment

- Max. Loan-to-Value (LTV)

- 85%

Why we chose this company: Flagstar (NMLS #417490) offers lines of credit of up to $1 million, which makes it the best HELOC option for large loans.

Flagstar’s home equity line of credit has variable interest rates and is available for amounts between $10,000 and $1 million.

Customers who set up AutoPay from a Flagstar deposit account can receive a 0.25% interest rate discount. The company also offers a 10-year drawing period and a 20-year repayment term.

Flagstar doesn’t charge closing costs (which typically include appraisal, title, notary and recording fees) as long as you maintain the HELOC open for at least 36 months. However, customers are responsible for paying government taxes and fees at closing and a $75 annual fee after the first year.

Eligibility requirements

- Property type – Primary residences, including 1-to-4 unit residential homes and secondary homes (1-unit residential homes)

- Credit score – Not disclosed

- Amount of equity available – Not disclosed

- Regional availability – Not available in Texas, Puerto Rico or the U.S. Virgin Islands.

Read Flagstar Home Equity Loans Review

See rates on Flagstar’s Secure Website >>

- No application, origination, annual or inactivity fees

- Borrows up to 100% of your home equity for HELOANS and up to 95% for HELOCs

- Longer 20-year draw period for HELOCs

- Membership limited to the military and their families

HIGHLIGHTS

- Annual Percentage Rate (APR)

- From 7.340% (HELOAN), 8.750% – 18.00% (HELOC) *HELOCs have a special advance rate of 7.59%. Terms apply.

- Loan Amount

- $10,000 – $500,000

- Terms

- 5 to 20 years

- Max. Loan-to-Value (LTV)

- 100%

Why we chose this company: Navy Federal Credit Union (NMLS #399807) offers the best home equity loans for military service members and veterans, with products that include loans with no application or origination fees and HELOCs with longer drawing periods than most competitors.

Navy Federal offers both fixed-rate equity loans and home equity lines of credit for loan amounts of $10,000 up to $500,000. In the case of equity loans, Navy Federal lets you borrow up to 100% of your home’s equity with repayment terms of five, 10, 15 and 20 years.

However, with a HELOC you can borrow up to 95% of your home’s equity at a variable rate. Navy Federal offers a longer than average 20-year drawing period, in comparison to the typical 10-year term most competitors offer. The company also covers closing costs, which can range from $300 to $2,000 for loans of up to $250,000.

Eligibility requirements

- Credit union membership – must be an active duty, retired or veteran of the armed forces, or an immediate family member

- Property type – primary residence, single-family home

- Credit score – Not disclosed

- Amount of equity available – Not disclosed

- Regional availability – HELOCS not available in Texas.

See rates on Navy Federal Credit Union’s Secure Website >>

- Rates starting at 6.75% APR

- HELOC can be converted into a fixed-rate loan

- No closing costs

- Property tied to the loan must be in a state with a Regions retail branch

- Branches only in AL, AK, FL, GA, IL, IN, IA, KY, LA, MS, MO, NC, SC, TN, and TX

HIGHLIGHTS

- Annual Percentage Rate (APR)

- 6.75% to 14.125%

- Loan Amounts

- $10,000 – $250,000

- Terms

- 10, 15 or 20 years

- Max. Loan-to-Value (LTV)

- up to 89%

Why we chose this company: Regions Bank (NMLS #174490) made our cut as the bank with the most flexible repayment terms because it offers term lengths between seven and 20 years.

Regions Bank offers fixed-rate home equity loans with no closing costs. Loan amounts range from $10,000 to $250,000.

In addition to home equity loans, Regions Bank offers home equity lines of credit (HELOCs). These start at $10,000 and go up to $500,000, with a 10-year draw and a 20-year repayment period.

Regions Bank covers full closing costs for credit lines of $250,000 or less. If your line of credit exceeds $250,000, Regions Bank will contribute up to $500.

Eligibility requirements

- Property type – Primary or secondary residence

- Credit score – Not disclosed

- Amount of equity available – At least $10,000

- Regional availability – Available in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, South Carolina, Tennessee and Texas.

See rates on Regions Bank’s Secure Website >>

- Multiple fixed-rate repayment options may be available

- Covers appraisal fee

- HELOC with no annual fee in most states

- Only offers HELOC

- Prepayment penalty for terminating a line of credit within 36 months

- $15 service fee

HIGHLIGHTS

- Annual Percentage Rate (APR)

- 8.50% – 16.00% (or state maximum)

- Loan Amounts

- From $5,000

- Terms

- 5, 10, 15, and 20 years

- Max. Loan-to-Value (LTV)

- Not disclosed

Why we chose this company: Truist (NMLS #399803) is our choice for the best fixed-rate HELOC because borrowers can choose fixed rates and fixed repayment terms of between five and 20 years.

Truist offers home equity lines of credit with three repayment options: interest-only, fixed and variable-rate repayments with zero-cost closing options. The minimum amount you can request for HELOCs is $5,000. Fixed-rate HELOCs may be subject to a $15 set-up fee. Variable-rate lines of credit, on the other hand, have a 10-year draw period and a 20-year repayment period.

The lender is currently offering an introductory HELOC rate of 7.49% for the first nine months from the date the account is opened, after which it reverts to a standard rate ranging between 8.50% and 16%. The offer is valid for applications made before July 31 and closed on by September 30, 2024.

Truist covers closing costs for lines of up to $500,000, although this may result in higher interest rates. Prepayment penalties on lines of credit may also apply if the account is closed within three years of opening. This means you’ll have to pay back any origination or closing costs covered by Truist, which can go all the way up to $10,000.

Eligibility requirements

- Property type – Single-family, primary residence, second home or condominium occupied by the owner

- Credit score – Not disclosed

- Amount of equity available – Not disclosed

- Regional availability – Available in Alabama, Arkansas, California, Florida, Georgia, Tennessee, South Carolina, Virginia, Maryland, Mississippi, Washington DC, West Virginia, Indiana, Kentucky, New Jersey, Ohio, Pennsylvania, North Carolina and Texas.

Read Truist Home Equity Review

See rates on Truist’s Secure Website >>

- No closing costs, although initial escrow-related costs may apply

- Interest rate will never exceed 18% APR, subject to applicable state law

- 0.50% interest rate discount with automatic payments deducted from a U.S. Bank account

- $75 annual fee may apply after the first year

- Early closure fee of 1% or up to $500 applicable during the first 30 months

- Home equity loans not available in Hawaii, Louisiana, New York, Oklahoma and Rhode Island if property is held in a trust

HIGHLIGHTS

- Annual Percentage Rate (APR)

- From 7.65% (HELOAN); 8.95% – 13.10% (HELOC)

- Loan amounts

- $25,000 – $750,000

- Terms

- 10 to 30 years

- Max. Loan-to-Value (LTV)

- 60%

Why we chose this company: U.S. Bank (NMLS #402761) has the best home equity loan for borrowers with good credit because it offers highly competitive interest rates for customers with scores of 730 or more.

To get the lowest rates, you’ll also need a U.S. Bank checking or savings account with automatic payments set up.

The company’s home equity loans and HELOCs do not have closing costs. Home equity loans have repayment terms of up to 30 years. Loan amounts start at $5,000 and go up to 60% of your home equity or $750,000 ($1 million in California).

While HELOCs feature variable rates, you have the option to convert a portion or the total amount of your balance to a fixed rate for up to 20 years. In addition to the fixed-rate payment option, any balance you don’t convert into a fixed-rate will continue to have a minimum payment and variable rate.

Eligibility requirements

- Property type – Primary residence, single-family home

- Credit score – Minimum 660

- Amount of equity available – Not disclosed

- Regional availability – Not available in Hawaii, Louisiana, New York, Oklahoma or Rhode Island if property is held in a trust.

Read U.S. Bank Home Equity review

See rates on U.S. Bank’s Secure Website >>

Other home equity loan companies we considered

While solid contenders, the following home equity loan lenders didn’t make it to the top of our list. Nevertheless, they might have features and products that are suited to your particular circumstances.

Bank of America

- No fees for converting a variable rate loan to a fixed rate

- 0.25% rate discount if you enroll in AutoPay using a BofA checking or savings account

- Up to 1.50% rate discount for initial withdrawals of $150k or more (0.10% for every $10,000)

- Only offers HELOCs

- Can’t open more than three fixed-rate loans at the same time

- Maximum APR is not disclosed

Bank of America (NMLS #399802) is another contender that offers home equity lines of credit. In addition, it features introductory rates and multiple rate discounts, such as 0.625% if you enroll in autopay and up to 0.750% for customers with a Preferred Rewards account. However, it doesn’t offer home equity loans nor does it readily disclose the maximum APR customers could pay.

Read Bank of America Home Equity Review

See rates on Bank of America’s Secure Website >>

BMO Harris Bank

- 0.50% AutoPay rate discount

- Fixed-rate options for HELOCs

- $75 fee each time you convert HELOC from a variable to a fixed rate

- Not all transactions are eligible for remote closing

- $75 annual fee each year during the draw period

BMO Harris Bank (NMLS #401052) offers both home equity loans and HELOC, which are available for customers with a minimum credit score of 700 or between 650 and 680, respectively. While BMO Harris home equity line of credit rates are competitive, it mainly operates in only eight states: Arizona, Illinois, Florida, Kansas, Indiana, Minnesota, Missouri and Wisconsin.

Read BMO Harris Bank Home Equity Review

See rates on BMO Harris Bank’s Secure Website >>

Frost

- No application or annual fee charges

- 0.25% rate discount with automatic payment

- APR rates for HELOANs starting at 7.18%

- No prepayment penalty for HELOC

Frost Bank (NMLS #431208) features competitive home equity loan and HELOC products, with terms of up to 20 years. Home equity loans and HELOCs are available starting from $2,000 and $8,000, respectively. Frost’s main drawback is that it’s only available in Texas, however, if you live in this state it may be an option worth considering.

See rates on Frost’s Secure Website >>

KeyBank

- 0.25% rate discount for having a KeyBank checking or savings account

- Borrow up to 80% of your home’s value

- Flexible payment options including principal and interest, interest-only or fixed

- Doesn’t openly disclose APRs for their home equity loans

- Only services 15 states

KeyBank (NMLS #399797) offers both home equity loans and lines of credit of up to 80% of your home’s value. Home equity loans are available from $25,000 to $500,000, whereas the minimum loan amount for HELOCs is $10,000. Like most banks, KeyBank also offers a 0.25% rate discount. However, its products are only available in Alaska, Colorado, Connecticut, Idaho, Indiana, Massachusetts, Maine, Michigan, New York, Ohio, Oregon, Pennsylvania, Utah, Vermont and Washington.

See rates on KeyBank’s Secure Website >>

PenFed

- Loan amounts from $25,000 up to $500,000

- Covers most closing costs

- Only offers HELOCs

- Does not offer lines of credit for certain types of properties

- Properties must be fully livable and have no safety issues to be eligible

PenFed (NMLS #401822) only offers home equity lines of credit with a 10-year draw period and a 20-year repayment period. Loan amounts range from $25,000 to $500,000. However, to apply you need to become a credit union member and have a minimum credit score of 680. It also charges an annual fee during the draw period.

See rates on PenFed’s Secure Website >>

PNC Bank

- Offers fixed and variable rate options on HELOCs

- Minimum draw amount in Texas is $4,000

- Potential home renovation tax benefits when renovating for medical purposes or installing energy efficient equipment

- $100 transfer fee each time borrowers opt for a fixed rate

- In Texas, only applicants with primary residences and LTVs under 80% are eligible

PNC (NMLS #446303) offers fixed-rate home equity lines of credit for balances of $5,000 or more and a 0.25% rate discount when you enroll in autopay. However, interest rates aren’t readily displayed on its website and it charges an annual fee of $50. In addition, its home equity products are not available in Louisiana, Mississippi, Nevada, South Dakota, Alaska and Hawaii.

Read PNC Home Equity Review

See rates on PNC Bank’s Secure Website >>

Spring EQ

- 640 minimum score for home equity loans

- Offers access to up to 90% of your home value

- Relatively fast funding, between 14 to 21 days

- Doesn’t disclose information about fees and rates

Spring EQ (NMLS #1464945) specializes in home equity products. You can access up to 90% of your home equity and borrow up to $500,000 with this lender.

Loan terms range from five to 30 years. The loan application process is completely online, providing instant qualification in most cases and funding between 14 to 21 days. However, it didn’t make our top picks as current fees and rates are not openly available on their website.

Read Spring EQ Home Equity Review

See rates on Spring EQ’s Secure Website >>

Unison

- Lets you convert up to 15% of your home equity into cash

- Single-family homes, townhouses and condominiums are eligible

- Doesn’t impact creditworthiness nor charges interest rates

- No payments for 30 years or until you sell your home

- Five-year restriction period, where Unison won’t share in the losses of your home’s value, if you sell

- May affect your eligibility for refinancing your mortgage

- Must pay back the co-investment plus four times the percentage invested after 30 years

Unison is a home equity loan alternative that offers home co-investing. Basically, the company lets you borrow up to 15% of your home value in cash in return for a share of your home’s future value. Although you don’t have to pay them back up to 30 years or until you sell your house, this alternative has several potential drawbacks. For instance, you may not be able to refinance your home, and if you don’t sell your home, you must pay back the original co-investment plus a percentage of your home’s increased value.

See rates on Unison’s Secure Website >>

Home Equity Loans Guide

Home equity loans and home equity lines of credit are some of the most popular ways to finance home renovations, pay off student loans or cover unexpected expenses like medical bills. One of the advantages of home equity loans is that the interest you pay is tax deductible if you use the loan to make home improvements. In this section we’ll explore how a home equity loan works, typical home equity rates, loan requirements, how to choose a lender and more.

What is a home equity loan?

A home equity loan (HEL or HELOANS) is a fixed-term loan product that uses the equity you’ve accumulated in your home as collateral. Often called a second mortgage, home equity loans let borrowers obtain a lump-sum payment that can be used for major home renovations, consolidating debts or paying for college tuition. This type of loan offers the option of paying it back in equal installments.

Home equity loans can have lower interest rates than credit cards or personal loans if you have a good credit score, but they put you at risk of losing your home if you are unable to make payments. Do note that the first mortgage remains the primary loan on a property if it still carries a balance.

How does a home equity loan work?

Home equity loans work as a second mortgage, allowing you to take out a loan against your property’s value. As with your primary mortgage, your home is at risk of foreclosure if you can’t make payments.

The loan amount depends on several factors, including your debt-to-income ratio (DTI), standard loan-to-value (LTV) ratio and combined loan-to-value ratio (CLTV). Typically, home equity loans are for a max of 80% to 90% of the property’s appraised value. Loan terms include a fixed interest rate and fixed monthly loan payments for up to 30 years.

Current home equity loan rates

Home equity loan interest rates are typically on par with mortgage loan rates. HELOC rates, on the other hand, are variable and can be somewhat higher depending on the bank and the prime rate.

When comparing rates, look at the annual percentage rate (APR) to get a more complete idea of what you’ll pay in interest and help you determine which lender offers the best rate.

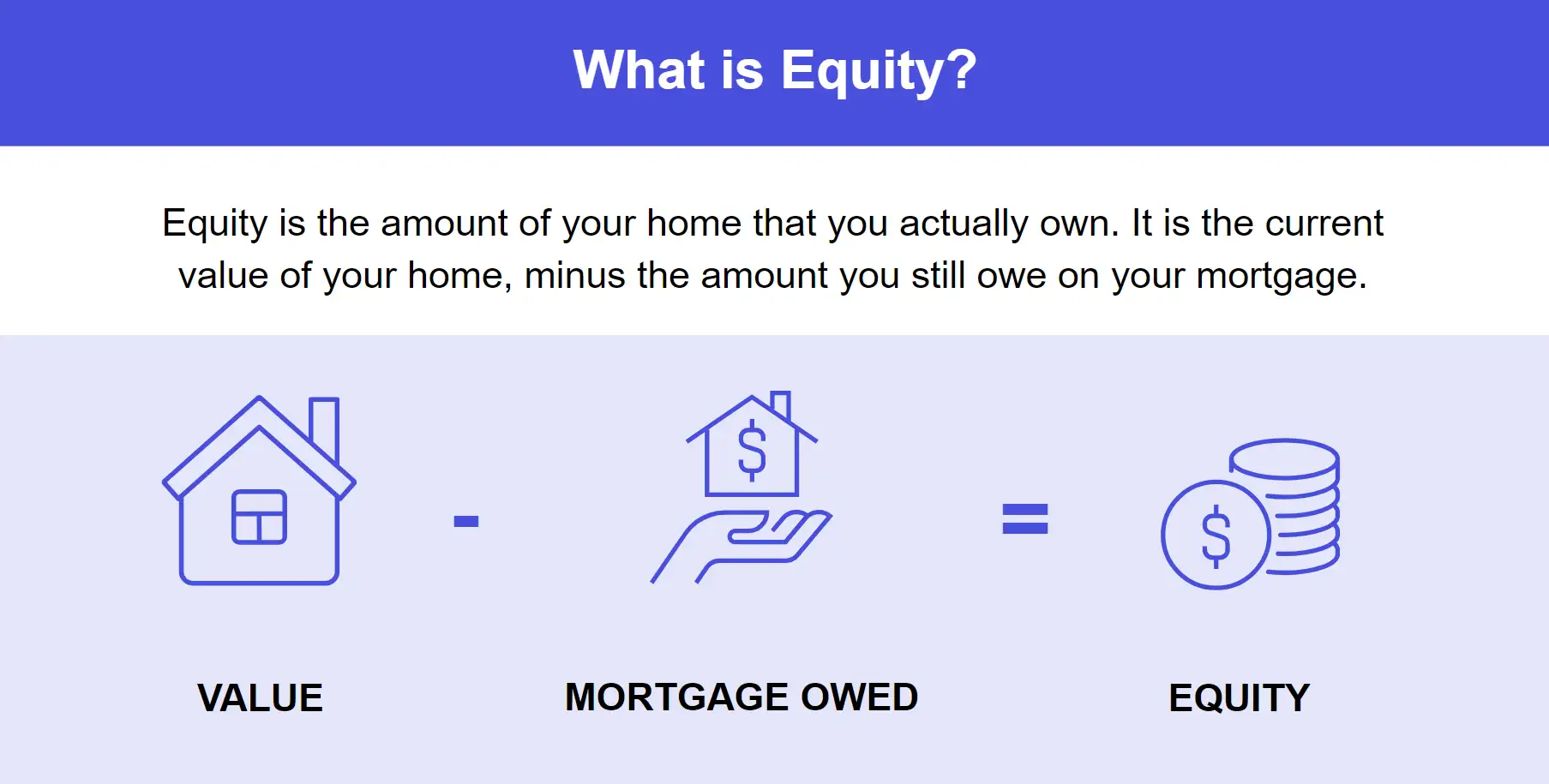

How to calculate home equity

Home equity refers to the difference between your mortgage balance (what you owe) and the current market value of your home.

Your equity can increase over time as you pay down the principal and if the value of your property goes up. It can also decrease if your home value drops.

To calculate your equity, you need to:

- Determine the current market value of your home. (In most cases, a certified real estate appraiser can help you obtain an official valuation.)

- Deduct your remaining mortgage balance (if you have one) from your home’s current market value.

For instance, if your home is worth $300,000 and you owe $175,000 of your mortgage, then your home equity is $125,000. If you’ve already paid your mortgage, your equity is your home’s full value.

Home equity loan requirements

When determining if you qualify for a home equity loan, lenders will typically check if you meet the following requirements:

- At least an 80% loan-to-value ratio, or the equivalent of 20% equity

- A low debt-to-income ratio, preferably under 43%

- A minimum credit score of 620 or higher

- Own a qualifying home, such as a single-family home, townhouse or condo

- Be employed, self-employed or retired and have a steady income

- Supporting documentation, such as pay stubs, tax returns and W2s

Naturally, the higher your home equity, the more you’ll be able to borrow. If you’re a recent homebuyer, focus on building equity before considering this type of loan. One way to do this is by making additional mortgage payments to your principal. Check our guide on how to build equity in a home for more actionable steps.

Pros and cons of home equity loans

Here are some advantages and disadvantages to consider when deciding whether a home equity loan is the best option for you.

- You get a fixed interest rate

- Predictable payments for the life of the loan

- Money can be used for any purpose (debt consolidation, paying for tuition, etc.)

- Interest may be tax-deductible, if the loan is used for home improvement

- Must use your home as collateral

- You’ll have a second mortgage if you’re still paying the primary mortgage

- You may have to pay closing costs, depending on the lender

- You need significant equity on your home, typically between 15% and 20%

How to choose a home equity loan

When looking for a home equity loan, consider the following steps.

1. Understand your options

There are two different types of home equity loans: traditional home equity loans and home equity lines of credit. Traditional HELOANs give you a lump sum, whereas HELOCs work much like a credit card. Read the section on differences between home equity loans and HELOCs for more information.

2. Compare loan terms and repayment options

Regardless of which option you choose, make sure you understand all the costs associated with the loan or line of credit. A fixed-rate loan means your rate and loan payments won’t change for the life of the loan.

If it’s a variable or adjustable-rate loan, know that your monthly payments will fluctuate with interest rates. While mortgage rates remain low, your payments will be low. However, those interest rates may start to go up at some point, which means your monthly payments will also increase.

3. Calculate how much you can borrow with a home equity loan

To determine how much equity you can borrow, you must calculate your loan-to-value ratio (LTV). To do this, divide your mortgage’s outstanding balance by your home’s current market value and convert that into a percentage. Let’s say your current mortgage loan balance is $175,000 and your home is appraised at $250,000. This means you have a loan-to-value ratio of 70% and 30% equity.

Because most lenders require you to keep at least 20% of equity in the home, you would only be able to borrow against 10% of your equity — in this case, $25,000. (The home’s current value ($250,000) by 10%, gives you the amount you’ll be eligible to borrow).

Another (simpler) way to calculate how much you can borrow is to multiply your home’s current value by 80% and subtract what you still owe from the total.

4. Check closing costs for home equity loans

Just like with primary mortgages, home equity lenders may charge closing costs. These can range anywhere from 2% to 5% of your loan total. Lenders may also charge an application fee in addition to costs for other services such as loan origination, appraisals, title search and attorneys. There are, however, no appraisal home equity loan lenders as well.

However, many lenders don’t charge some of these fees and may even be willing to waive closing costs altogether, on the condition that you won’t pay off the loan before a certain period of time (typically three years). If you close the loan before then, you must pay back all the costs the lender covered.

Some lenders may also offer somewhat higher interest rates in exchange for reducing or covering closing costs or fees.

How to get a home equity loan

Once you’ve chosen your home equity lender, you will typically need to get an appraisal, gather your financial information and apply for the loan. Check out our guide on how to get a home equity loan for more information.

Alternatives to home equity loans

Aside from home equity loans, there are several ways to tap into your home’s equity: home equity lines of credit (HELOC), cash-out refinance loans and home co-investing.

Most of these loan options require equity in your home, but they all have different characteristics and qualification requirements.

Home equity loan vs HELOC

When deciding between a home equity loan and a home equity line of credit, keep in mind these key differences:

Most have a fixed interest rate.

HELOCs typically have a variable interest rate, which can increase or decrease over time. (Some banks may let you convert your variable rate into a fixed rate later on)

Access to funds is through a single upfront lump sum.

Allows you to withdraw funds as needed up to a preset credit limit for an established period of time (draw period).

Available with terms from five up to 30 years

Typically has a 10-year draw period and a 20-year repayment period.

You pay interest plus principal for the determined repayment period.

Options to pay interest only during the draw period are typically available.

Home equity loan vs. cash-out refinance

Home equity loans and cash-out-refinances are a way to get cash for home improvement projects or debt consolidation using some of your home equity. Some homeowners, however, prefer refinancing their existing mortgage rather than take on a new loan. These are the differences to consider:

Gives you a lump sum in exchange of your home equity, creates a second mortgage on the property.

Pays you part of your home equity in cash, and replaces your existing mortgage with a new one.

The terms of the original mortgage won’t change. Instead, you’ll have two loans.

You may refinance at a lower interest rate, if available.

Interest rates are typically somewhat higher than mortgage rates.

Interest rates are typically lower because they’re based on current mortgage rates.

Tax deductible if the funds are used to improve your home.

Interests on the principal are tax deductible as any other mortgage. You may also deduct the cash-out portion if used for home improvements.

Home equity loan vs. personal loan

A personal loan can be a viable alternative to a home equity loan for some. When choosing between the two, keep these key differences in mind.

Home serves as collateral, so rates are lower

Typically unsecured, as a result rates tend to be higher

Borrowing limits are generally higher, and are determined by the amount of equity in the borrower’s home.

Borrowing limits are lower, and based on the borrower’s creditworthiness, income, and other factors.

Interest paid can be tax deductible if the funds are used to improve your home.

Generally not tax-deductible, regardless of how the funds are used.

Carries the risk of losing your home if you default

Lenders cannot seize assets if the borrower defaults, but can still damage the borrower’s credit score

Best Home Equity Loans FAQs

Can you get a home equity loan with bad credit?

There are some home equity and HELOC lenders who are willing to consider applicants with credit scores in the 600s. However, expect to pay higher interest rates and be required to have at least 20% equity in your home.

Going with your current mortgage lender could be a good move. If you have a track record of on-time payments and a stable income, they might approve your application even with a less-than-perfect credit score.

How long does it take to get a home equity loan?

Timing can vary greatly depending on the home equity lender. In most cases, it can take between two and four weeks to close the loan, whereas funding may take a few days after closing.

How can you use a home equity loan

You can use a home equity loan to add value to your property by way of home improvements. You can also use it to consolidate debts, invest in a new business venture, create an emergency fund, pay education bills, or cover unexpected expenses.

How We Chose The Best Home Equity Loans

The methodology we used to narrow down our list of the top home equity loan providers includes researching and vetting each lender and evaluating them on the following criteria:

- Price transparency: We evaluated the loan types offered, minimum and maximum loan amount, interest rates, loan terms and credit score requirements for each lender.

- Application process: We checked eligibility requirements and approval times. In addition, we compared application and evaluation fees, and whether application services were available online, by phone or in person.

- Reputation and customer satisfaction: We looked into two main data sources: J.D. Power’s 2022 U.S. Mortgage Servicer Satisfaction Study and complaint data as reported by the Consumer Financial Protection Bureau (CFPB).

Summary of Money’s Best Home Equity Loans of September 2024

The companies below are listed in alphabetical order.